Roth Ira Contribution Limits 2025 By Salary

Roth Ira Contribution Limits 2025 By Salary. In 2025, the roth ira contribution limits for most people are $6,500, or $7,500 if you're 50 or older. In 2025, the roth ira contribution limit is $7,000, or.

The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. The roth ira contribution limit for 2025 is $7,000 in 2025 ($8,000 if age 50 or older).

Roth Ira Limits 2025 Chart Moira Tersina, Income limits for a roth ira set the maximum earnings individuals or couples can have to qualify for contributions within a specific year.

Roth Ira Contribution Limits 2025 Salary Cap Irena Leodora, In 2025, the max ira contribution you’re able to make is $7,000.

Roth 401 K Contribution Limit 2025 Tabby Carolin, In 2025, the roth ira contribution limits for most people are $6,500, or $7,500 if you're 50 or older.

What Is a Backdoor Roth IRA Benefits and How to Convert Top Dollar, In 2025, these limits are $7,000, or $8,000 if you're 50 or older.

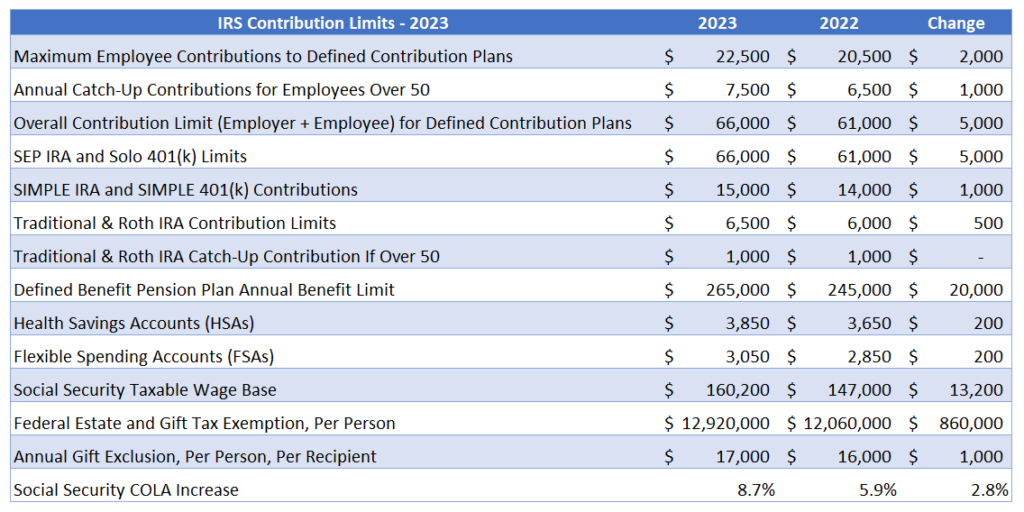

2025 IRS Contribution Limits and Tax Rates, In 2025, the roth ira contribution limits for most people are $6,500, or $7,500 if you're 50 or older.

Roth Ira Contribution Limits 2025 By Salary Oona Torrie, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year was $7,000 or $8,000 if you were age 50 or older.

Roth Ira Limits 2025 Salary Cap Johna Charlot, You can make 2025 ira contributions until the unextended federal.

Roth Ira Limits 2025 Salary Cap Johna Charlot, The roth ira contribution limit for 2025 is $7,000 in 2025 ($8,000 if age 50 or older).